Crypto and Mobile in 2022 Series Part 4: User numbers for crypto & digital currency apps soar

Tiahn Wetzler, Director, Content & Insights, Adjust, Mar 31, 2022.

As we explored in our recent Fintech Deep Dive: Digital currencies 2022 playbook, the world’s attention has been fixated on crypto more than ever over the past few years. This swathe of attention has propelled the topic onto mobile, and marketers and developers have begun carving out clever ways to drive crypto adoption and turn apps into a key access point for digital assets.

As a relatively new vertical on mobile, the growth of apps that fall into the category of ‘crypto’ has been exponential. Industry trends like Bitcoin adoption, stablecoins and payments, decentralized finance, memecoins, NFTs, gaming, and the Metaverse are the key building blocks behind this ever-evolving cultural and commercial phenomenon.

In this blog, we take a closer look at how installs and sessions have grown over recent years to help mobile advertisers better understand the huge opportunity for growth in this space in 2022.

Crypto app downloads, installs, and growth

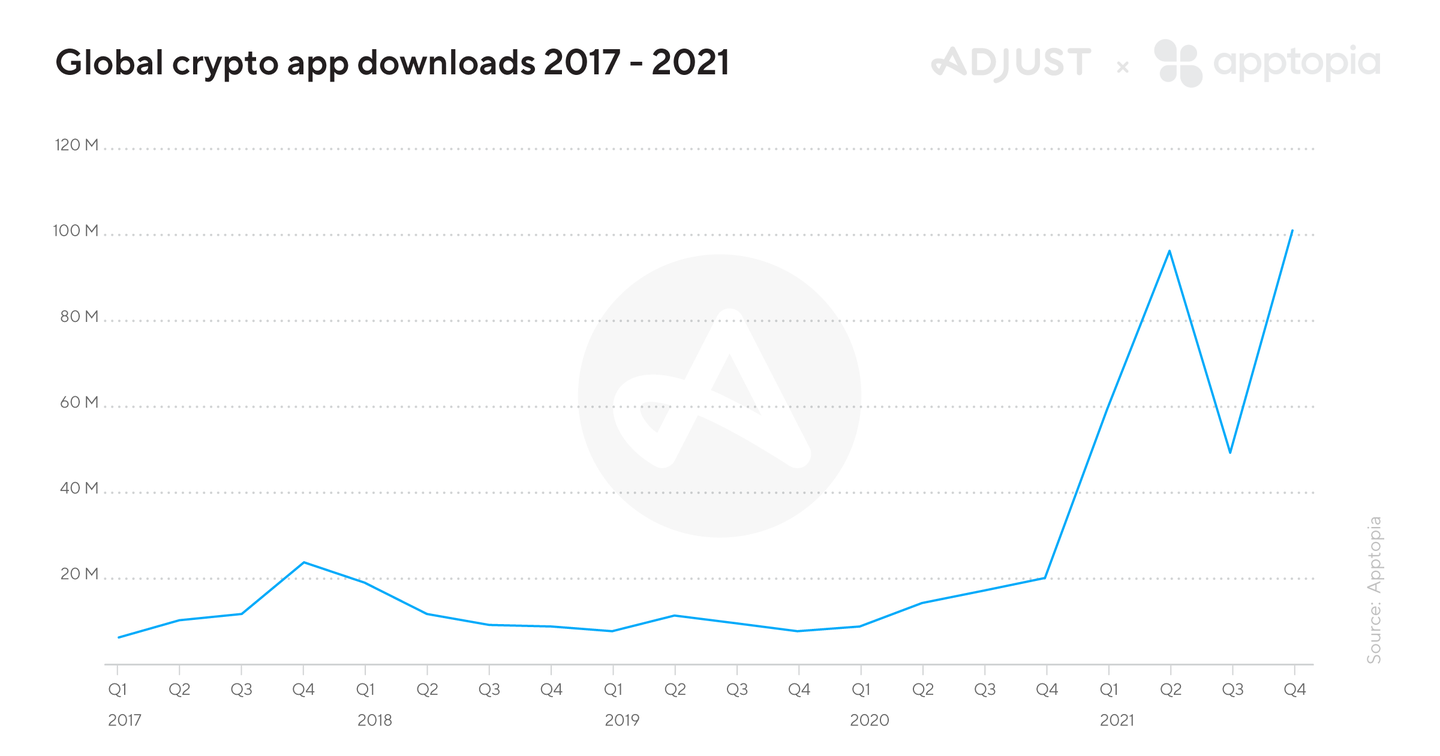

Throughout 2021, crypto app downloads and installs underwent massive growth. Having remained stable since their previous boost in Q4 of 2017, a fresh downloads uptick started in 2020, where Apptopia data shows that year-on-year growth was as high as 64%. For 2021, however, this figure skyrocketed to 401%.

The patterns we can see within 2021 are also crucial to note. Downloads dropped 49% from Q2 to Q3 but bounced back by 106% in Q4, matching the Bitcoin and overall crypto price movements, demonstrating the importance of these fluctuations for user acquisition (UA) and reengagement. The first boost that can be seen on the chart below took place in April when Bitcoin reached nearly $64,000, followed by a new peak in November when the price hit $69,000.

Looking at Adjust data to put a lens on H2 of 2021, we see the same patterns represented in installs, which rose 304% between the end of June and the first week of August, before declining by 45% in September, and then hitting a record in November (along with Bitcoin’s record).

At a regional level, growth from 2020 to 2021 was impressive across all regions, despite differences in jurisdictions and rules around advertising or even within developing apps in this category. EMEA charted the highest year-on-year growth at 572%, with many crypto-friendly markets in the region, followed by North America at 230%.

By taking a look at this growth in comparison to other fintech categories, which also grew immensely over the past 24 months as a result of fast-tracked digitalization in markets across the globe during COVID-19 related lockdowns, the extent to which crypto is captivating the market is made extremely apparent. Banking, payment, and stock trading all saw impressive, sustained growth, hitting 27%, 25%, and 31%, respectively, but this is entirely eclipsed by the 455% seen for crypto.

The number of apps in the app store has also grown steadily. An initial consistent incline can be seen in 2017 and 2018, which is around the time of the first “crypto bull run”. This escalation starts to recede in 2019 and early 2020 before picking back up again from July 2020 onward. This trend line coincides seamlessly with Apple’s revision of its privacy guidelines in June 2018 for cryptocurrency apps. Apple’s move banned cryptocurrency mining for iOS devices, required crypto securities to be offered by registered financial institutions only, and specifically banned apps that offered cryptocurrencies as rewards for in-app tasks/events.

Sessions and the engaged crypto currency app user base

As the crypto app market matures, it’s becoming easier to identify trends and behaviors specific to the user base. Given the high retention rates for the vertical (which we get into in detail in the next blog in this series), it’s no surprise that churn rates are low, and session numbers are high.

According to data from Apptopia, sessions rose 63% from 2019 to 2020 before growing by a stunning 567% in 2021.

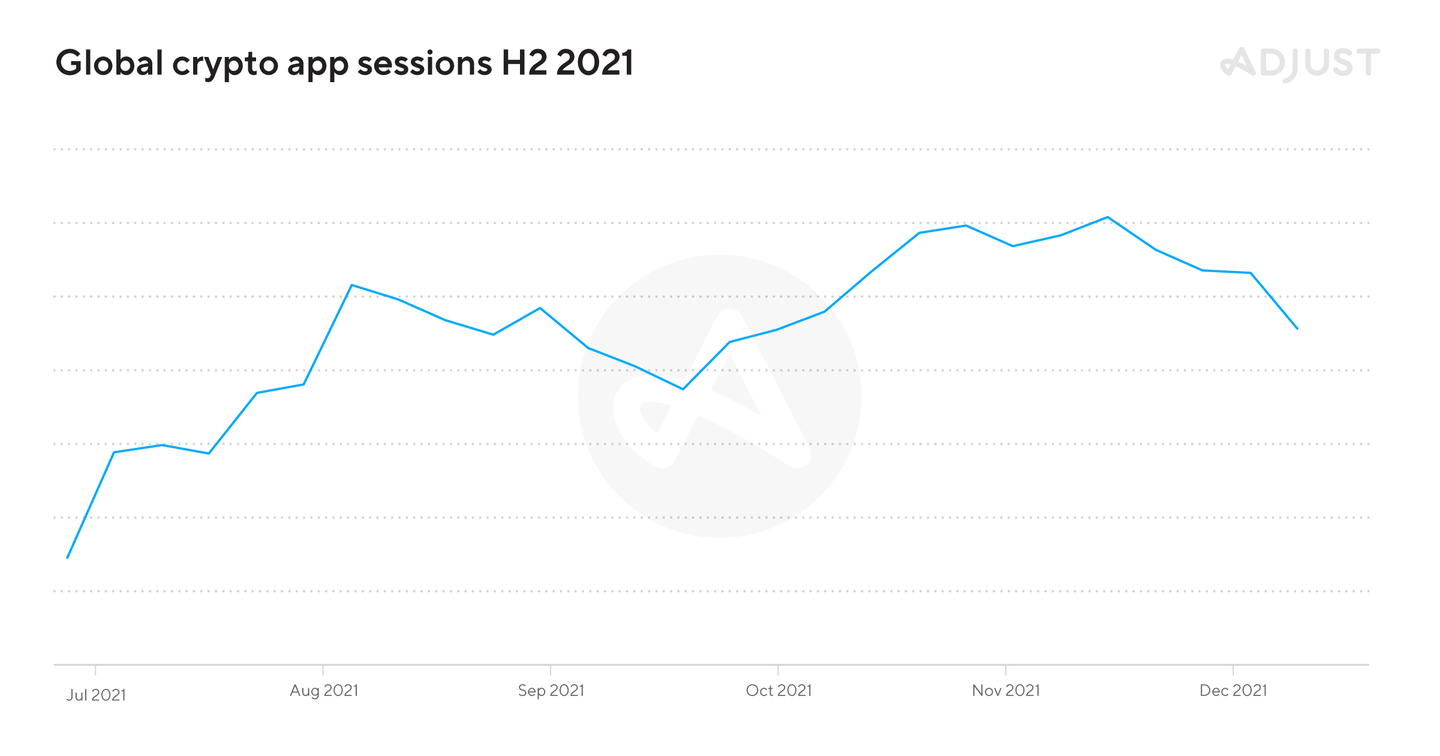

Taking a closer look at H2 2021 via Adjust data, we can see that Q3 and Q4 grow gradually but steadily, rising by 300% between June and November.

Session lengths are also very long compared to the crypto’s fintech cousins — though it’s important to note that banking and payment apps require significantly shorter sessions for task completion and that the comparison isn’t necessarily a “tell-all”. Crypto app users in 2021 clocked an average of 15.16 minutes per session, followed by stock trading at 11.71, payments at 5.02, and banking at 5.01.

At a regional level, and in line with install numbers, it’s EMEA that leaped ahead, reporting growth of more than 1000% in the average number of sessions. The next biggest boost is seen in North America at 544%, followed by APAC at 159%.

If we compare this growth to the other fintech subverticals, the results and narrative are also similar to installs. All subverticals perform exceptionally well from 2020 to 2021, but crypto outshone the rest of the group dramatically with its astronomical 729% growth. To put this into perspective, stock trading comes in second at 135%, a number that’s already extremely impressive.

For marketers and developers looking to get started in the crypto space, or to optimize their strategies, it’s exceptionally important to understand the unique waves of interest in this ecosystem. Growth might not always be predictable, but the users acquired at peak times are demonstrating long session lengths and consistent session numbers. To distinguish yourself from the competition, cultivating user engagement throughout these ups and downs is essential. New features, network integrations, asset listing, and educational materials can all prove pivotal in keeping users engaged while pulling in new users.

Remaining incredibly data-driven via measurement is crucial to understanding the way your users behave when they can most effectively be engaged and monetized, and how you can create cohorts to improve overall UA and retention.

To learn more about the growth, trends, and drive factors in the ever-evolving world of crypto apps and how you can make the most of them as part of your mobile marketing strategy, download our Fintech Deep Dive: Digital currencies 2022 here.

Be the first to know. Subscribe for monthly app insights.